No excess. No deductible

Claims paid in 5-days.

With automatic renewal.

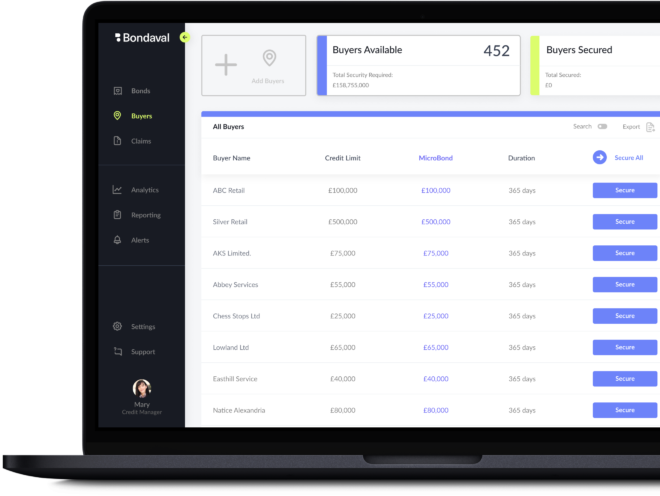

Integrate with your ERP, or use our standalone platform.

Use alongside, or instead of, existing security.

Security can be paid for by supplier, buyer or split.

Frequently asked questions

Bondaval is a fintech providing a better way to secure credit risk. Partnering with insurers rated A and above, Bondaval offers a more secure, capital-efficient and cost-effective form of secured credit that can be issued, amended, renewed and claimed-on digitally.

Existing instruments can take months to secure and hold significant downsides. Examples include:

Trade Credit Insurance. Policies typically require risk sharing in the form of a deductible and/or co-insurance. They tend to include past due notifications, cease shipment clauses, application of funds language, collection fees for protracted default recoveries, as well as claim filing waiting periods and deadlines. The task of completing due diligence on the credit worthiness of receivables tends to fall to the Supplier's credit and collection team to confirm the receivables can be considered insured risk.

Letters of credit and other bank-issued guarantees. Priced and collateralized as if banks were lending the buyer money, creating a needless capital squeeze on the buyer.

Personal guarantees and collateral requirements. Put strain on the supplier-buyer relationship and lead to a needless capital squeeze on the buyer

Bondaval provides a security instrument backed by its insurer partners’ balance sheets, administered via its own digital platform (or the ERP of its customers via API).

This provides a more secure, capital efficient, and convenient solution.

Our bonds are irrevocable instruments. Their terms are binding and provide for quick payouts (typically within 5 days), with no past due reporting necessary. Waiting periods and claim filing windows are not required. Cover is non-cancellable and up to 100% of the required limit.

Like letters of credit, MicroBonds secure buyer’s payment obligations per a supply contract.

Unlike letters of credit, MicroBonds require no collateral with issuance, renewal, and adjustment taking minutes, not months.

Our products are competitively priced versus alternatives. Suppliers can choose to pass along the cost to their buyers with the click of a button, or choose to pay for some, or all, of the cost of the security.

With MicroBonds, the cost of each bond can be tailored to each buyer's risk profile and required credit limit, or priced at a flat premium rate across a portfolio.

We are live and licensed in the UK, USA, Europe and Canada.

The future of B2B credit risk protection

-

Non-cancellable coverage

-

Up to 100% balance sheet protection

-

Secured and adjusted digitally